If you’re considering purchasing an investment property, you may be wondering which strategy is better: timing the market vs time in the market.

All financial markets, including the property market, can be volatile and difficult to predict. While some claim that timing the market is possible, time in the market as a long-term investment strategy is generally the best way to avoid volatility and minimise risk.

In this guide, we will cover the pros and cons, risks and considerations of both of these approaches and offer practical advice on purchasing a property.

Understanding timing the market vs time in the market

What is timing the market?

Timing the market refers to an investment strategy that involves making predictions based on market fluctuations. The idea is to buy a property or other investment during market lows and sell it at a high price to make a profit. Historically, this method of investment, both in the financial and property markets, has tended to be quite risky, as markets are volatile and difficult to predict.

Some claim that timing the market is possible; however, this approach requires far more effort, and there is no guarantee that you will hit your investment objectives. For inexperienced investors, mistiming the market can lead to significant financial losses.

What is time in the market?

Time in the market refers to an investment strategy that involves holding assets for longer periods. Time in the market helps significantly reduce the risk of mistiming short-term market movements, positioning investors to better weather temporary market fluctuations.

Historically, property values have tended to rise over time, allowing long-term investors to benefit from consistent appreciation and growing equity year after year. This steady approach often leads to greater long-term success.

The risks and disadvantages of trying to time the market

Market unpredictability

Property markets are influenced by a multitude of factors, including interest rates, economic cycles, policy cycles, supply and demand, as well as national or global events. Predicting the impact of these factors on property prices is a challenging task that requires a substantial amount of knowledge, research, and effort.

Opportunity costs

Waiting for the right time can mean holding onto your cash while prices continue to rise. This means that you are missing out on potential positive market gains, and you risk paying more for a property in the long term.

Transaction costs

Real estate as an investment can often incur high entry and exit costs, including property settlement fees, agent fees, legal fees, stamp duty (now commonly referred to as transfer duty), and more. While timing the market may allow you to recoup some of these expenses, mistiming it can lead to substantial financial losses. Holding your property for the long term is often more beneficial and offers more significant returns in the long run.

Small differences don’t matter

The potential gains from trying to time the market are often minor compared to the long-term growth achieved by simply holding the property. Many properties appreciate steadily over time, offering more substantial returns for patient investors. In the grand scheme, paying an extra $20,000 today is unlikely to matter if your property’s value grows by hundreds of thousands over the next 20 years.

Why time in the market wins in real estate

Property values rise over time

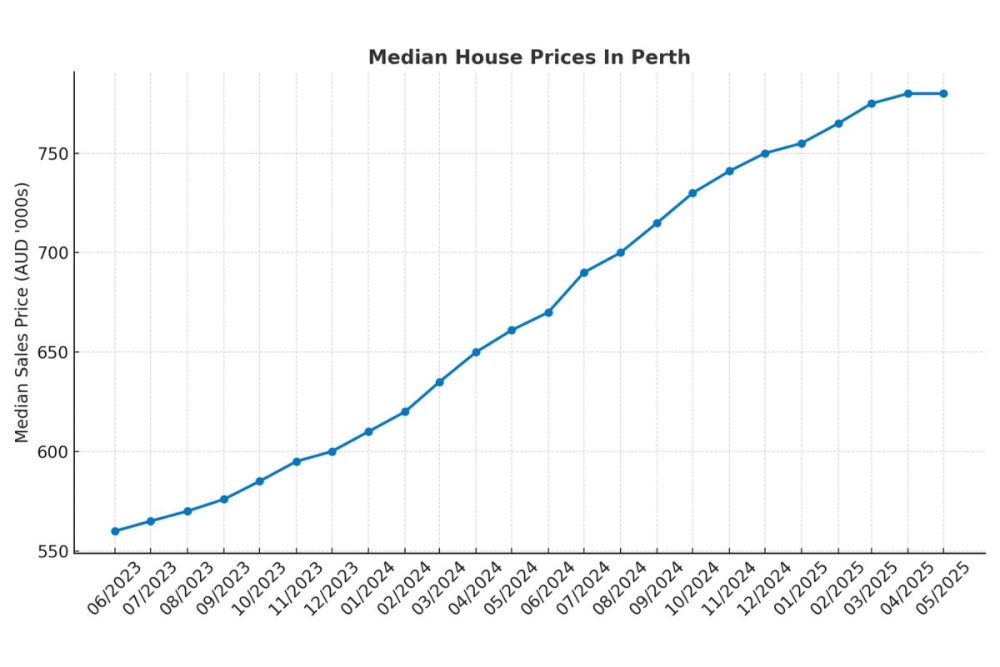

Over time, property values increase. Over the past couple of years, the median home price in Perth has increased significantly. If you purchased a home in 2023, the house has likely appreciated considerably in value, as shown in the graph above.

Less risk of mistiming

The property market is volatile due to changes in interest rates, government policies, economic downturns, and other factors. By committing to a long-term property investment strategy, you can ride out the short-term fluctuations without it affecting your wealth.

Compounding growth

Compounding growth is when the value of your investment grows over time, and then that growth itself starts to grow.

In property, this can occur in several ways. For example, if the value of your property increases, that growth is added to your total investment. Future performance is then calculated on this new, higher value, not just your original investment.

The best strategy: Balance and smart decision-making

The best investment strategy combines balance with smart decision-making. While perfectly timing the market is nearly impossible, it’s still important to consider market conditions as part of your overall strategy.

Here are some things to consider to apply a more balanced approach:

Understand your goals and risk tolerance

Before choosing an investment strategy, it’s essential to consider your financial goals, what you want to achieve with your investment, and the level of risk you are willing to take on. If you are looking for quick capital gains by timing the market, are you willing to take on a high level of risk? If you plan to hold onto a property, will you be able to withstand market downturns?

Choosing the right property, not just the right time

Instead of fixating on perfect market timing, invest your energy in finding the right property in a strong location, one that will deliver solid long-term performance. Prioritise properties with high rental demand and strong potential for capital growth. The perfect property for a fair price is better than a fair property for a perfect price.

Leverage expert advice

Work with experienced real estate professionals who understand market cycles and your individual needs. Whether you are looking to buy or lease a property, a good advisor will help you identify opportunities that align with your long-term goals.

Should you focus on market timing or long-term investing?

Rather than focusing on timing the highs and lows of the market, it’s recommended that you stay invested through full market cycles. Timing the market is nearly impossible, requires more resources, incurs more risk, and, quite often, the returns are not worth it.

Get in contact with the team at HKY Real Estate today for expert property investment advice and support.

Have more questions?